5 Lending Solutions to Improve Cash Flow for Growing E-Commerce Businesses

Author

Karol ZielinskiScaling an e-commerce business isn’t just about selling more – it’s about managing cash flow strategically to support that growth.

Even the most successful online stores face cash flow gaps, seasonal slowdowns, and the challenge of investing in inventory, marketing, or logistics before revenue catches up.

That’s where lending solutions come in.

But not all financing options are created equal. Some offer flexibility, others speed, and some align with how revenue flows through your business. The right choice depends on your goals, sales patterns, and risk tolerance.

Here are five essential lending solutions that can fuel e-commerce growth – and real-world examples of how they work.

1. Working Capital Loans – Fast Cash When You Need It Most

💡 Example: Shopify Capital

Working capital loans provide quick access to funds for essential expenses like inventory, advertising, or hiring.

The best part? Platforms like Shopify Capital integrate directly with your sales data, offering pre-approved funding without a credit check.

How it works:

- You apply through your platform (e.g., Shopify).

- If approved, funds are deposited within days.

- Repayment is automated, deducted as a percentage of future sales.

Why it’s useful for e-commerce:

- Helps businesses scale during peak seasons.

- No fixed monthly payments—repayment adjusts based on sales.

- Quick approval process with no lengthy paperwork.

Potential downside:

Repayment is automatic, so if sales slow down, it still eats into your revenue.

Use this when you need a fast cash injection to seize growth opportunities.

2. Line of Credit – A Flexible Financial Safety Net

💡 Example: Amazon Lending

A line of credit functions like a business credit card but often with better rates and larger limits.

How it works:

- You’re approved for a credit limit.

- You draw funds as needed.

- You only pay interest on what you use.

Amazon Lending is a prime example, offering select Amazon sellers lines of credit to manage inventory purchases, supplier deals, or seasonal slowdowns.

Why it’s useful for e-commerce:

- Provides flexibility—borrow what you need, when you need it.

- Interest costs are lower than many short-term loan options.

- Helps cover unexpected expenses without disrupting cash flow.

Potential downside:

Not all e-commerce platforms offer built-in credit lines like Amazon does. You may need to apply through a bank or fintech lender.

A line of credit is perfect for handling cash flow fluctuations without the pressure of fixed loan payments.

3. Merchant Cash Advances – Fast but Expensive

💡 Example: Stripe Capital

Merchant cash advances (MCAs) provide upfront cash in exchange for a percentage of future sales.

How it works:

- You receive a lump sum.

- Instead of fixed repayments, you pay back a portion of daily sales until the full amount (plus fees) is repaid.

Stripe Capital offers this option to businesses processing payments through Stripe, making it a fast and easy way to secure funding.

Why it’s useful for e-commerce:

- Approval is based on sales volume, not credit history.

- Repayments scale with revenue—slower sales = lower payments.

- No rigid monthly payment schedules.

Potential downside:

- High fees—the equivalent of 20-50% APR isn’t uncommon.

- If sales drop significantly, the debt can take longer to repay, increasing costs.

MCAs work best for short-term financing needs where speed is more important than cost.

4. Revenue-Based Financing – Growth Without Dilution

💡 Example: Clearco

Revenue-based financing (RBF) is similar to an MCA but structured more favorably for businesses with predictable growth.

How it works:

- You borrow a fixed amount.

- Repayment is a set percentage of revenue until the full amount is repaid.

Platforms like Clearco specialize in funding fast-growing e-commerce brands, helping them invest in inventory, ads, and expansion without giving up equity.

Why it’s useful for e-commerce:

- No dilution – you don’t give up company shares.

- Scales with revenue – pay more when you grow, pay less when sales slow.

- Often cheaper than MCAs, with transparent fees.

Potential downside:

- Requires strong revenue growth to be cost-effective.

- Not all e-commerce businesses qualify—funding is based on metrics like ad spend and sales volume.

This is ideal for brands that need growth capital without taking on investors or high-interest debt.

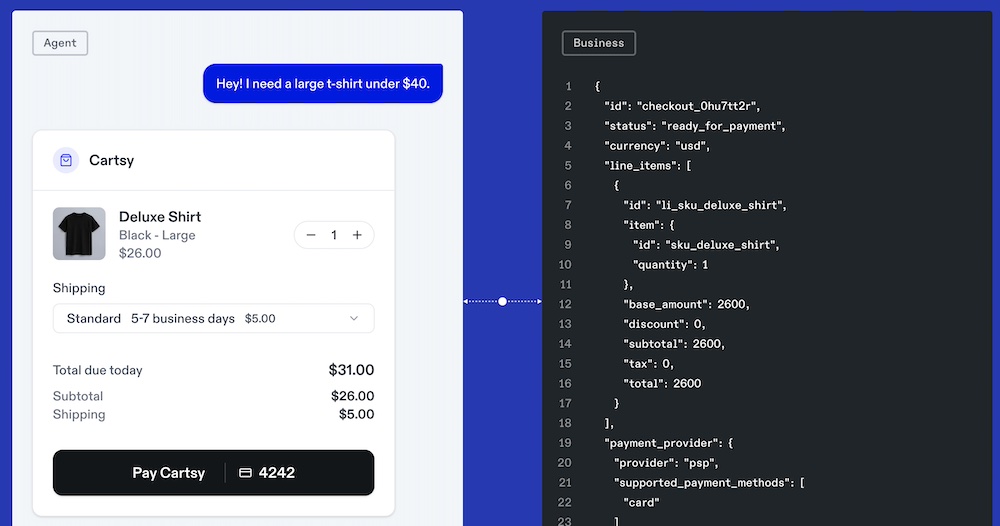

5. Installments, Leasing, and B2B BNPL – Financing Purchases from Suppliers

💡 Examples: TreviPay, Billie, Hokodo

E-commerce businesses, like any other company, need to purchase inventory, equipment, and services – often before they generate revenue from selling those products.

Instead of paying upfront, businesses can finance supplier purchases through:

- Installment plans – spreading payments over several months.

- Leasing – ideal for expensive equipment, like warehouse automation or packaging machines.

- B2B BNPL (Buy Now, Pay Later) – similar to consumer BNPL, but for businesses purchasing from suppliers.

How it works:

- The e-commerce company orders goods from a supplier.

- Instead of paying the full amount upfront, they choose a financing option.

- The BNPL provider or financial institution pays the supplier immediately, while the e-commerce business repays over time.

B2B BNPL providers like TreviPay, Billie, and Hokodo make this process seamless, integrating directly into supplier checkouts.

Why it’s useful for e-commerce?

- Improves cash flow – businesses can sell products before fully paying for them.

- Preserves working capital – funds can be allocated to growth instead of bulk inventory purchases.

- Easier access to financing – often requires fewer credit checks than traditional business loans.

Potential downside:

- Financing costs – depending on the terms, interest or fees may apply.

- Some suppliers may limit available credit or impose spending thresholds.

For e-commerce businesses, supplier financing is a powerful tool to scale inventory, optimize cash flow, and seize bulk order discounts without tying up all available funds.

Choosing the Right Lending Solution for Your E-Commerce Business

The best lending option depends on your:

- Business model (Are sales seasonal? Are margins tight?)

- Growth stage (Are you scaling aggressively or stabilizing cash flow?)

- Risk tolerance (Are you comfortable with revenue-based repayments or do you prefer fixed structures?)

Here’s a quick guide:

| Lending Solution | Best For | Key Advantage | Key Risk |

|---|

| Working Capital Loans | Short-term growth | Fast, automated approval | Fixed repayments can strain cash flow |

| Line of Credit | Ongoing flexibility | Only pay interest on what you use | Requires strong financials to qualify |

| Merchant Cash Advances | Quick but expensive funding | No fixed repayments | High costs if sales drop |

| Revenue-Based Financing | Growth without dilution | Payments scale with revenue | Works best for high-growth brands |

| Installments, Leasing, and B2B BNPL | Financing supplier purchases | Improves cash flow by spreading payments | Financing costs and supplier credit limitations |

Final Thoughts

The right lending solutions keep your cash flow steady.

They give you room to grow.

And they help you capitalize on opportunities when they arise.

Scaling isn’t just about selling more – it’s about having the financial tools to manage that growth wisely.

Pick the right ones. Use them strategically.

That’s how you turn potential into profit. 🚀

Need help integrating FinTech solutions? That’s exactly what we do at z3x FinTech.

And if you’d rather stop worrying about your payment processes without hiring a full-time specialist, our External Head of Payments service might be just what you need.

Let’s talk! 🚀