Debt collection has long been a challenge for financial institutions, often burdened by inefficiencies, low customer engagement, and delayed payments. Traditional approaches rely heavily on reminders, penalties, and legal actions – strategies that can lead to customer dissatisfaction and suboptimal recovery rates.

Wandoo Finance, a digital lending company, recognized the need for a more innovative and customer-friendly approach to debt recovery. Partnering with z3x tech care group, they set out to revolutionize their collections strategy by incorporating gamification elements into the process.

By introducing game mechanics such as rewards, levels, and behavioral incentives, Wandoo Finance aimed to make debt repayment more engaging and motivating, ultimately improving collection rates without harming customer relationships. This case study explores how gamification transformed Wandoo Finance’s debt collection strategy, leading to measurable improvements in efficiency, repayment speed, and customer satisfaction.

About the Client

Wandoo Finance is a digital lending company specializing in short-term consumer loans. Operating in multiple European markets, the company focuses on fast, data-driven credit decisions, offering customers a seamless online borrowing experience.

With a strong emphasis on technology and automation, Wandoo Finance continuously seeks innovative ways to optimize its lending operations, improve risk management, and enhance customer satisfaction. As part of its commitment to efficiency, the company identified debt collection as a key area for improvement, aiming to reduce delinquency rates while maintaining a positive customer experience.

To achieve this, Wandoo Finance partnered with z3x to design and implement a gamification-driven debt collection strategy, introducing new incentives and behavioral triggers to encourage timely repayments.

The Challenge

Debt collection is a crucial aspect of any lending business, but traditional methods often lead to low engagement, customer resistance, and inefficient recovery processes. Wandoo Finance faced several key challenges in its collections strategy:

- Low customer motivation to repay on time – Borrowers often deprioritized debt repayment, leading to increased delinquency rates.

- Inefficient engagement methods – Standard reminders and penalty-based approaches had limited effectiveness, especially among younger, digital-savvy borrowers.

- Negative customer experience – Harsh collection tactics could damage customer relationships, reducing the likelihood of future borrowing.

- Operational inefficiencies – The collections team spent significant time following up with customers, creating additional workload and operational costs.

Wandoo Finance needed a fresh approach that would align with its digital-first strategy, encourage voluntary repayments, and reduce friction in the collection process. That’s where z3x stepped in to introduce a gamification-driven solution that would transform the company’s approach to debt recovery.

Our Approach

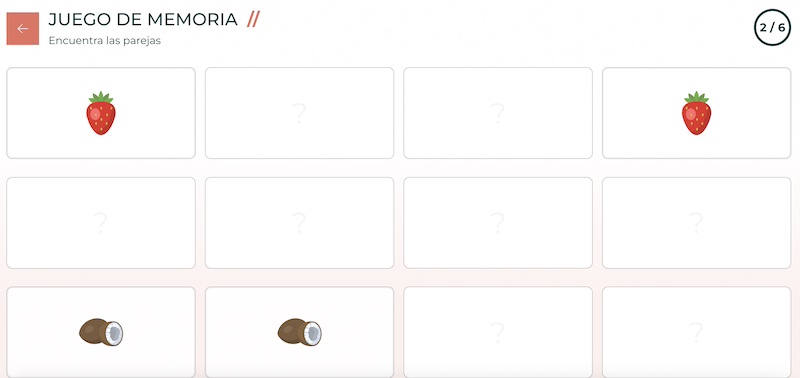

To transform Wandoo Finance’s debt collection strategy, z3x introduced a gamification-driven behavioral incentive system that leveraged simple yet engaging online games to encourage repayments and strengthen customer relationships. The key elements of this approach included:

1. Gamified Debt Collection Reminders

Instead of traditional payment reminders, we designed interactive online games that were sent to customers during the debt collection process. These games:

- Provided an enjoyable experience while subtly reinforcing the importance of repayment.

- Incorporated playful nudges reminding users of their outstanding balance without the stress of traditional collection messages.

- Increased customer engagement, making repayment reminders feel less intrusive and more interactive.

2. Games for Customer Activation & Brand Engagement

Beyond debt collection, Wandoo Finance also used gamification to engage potential customers by offering simple online games that:

- Introduced the brand in a fun and approachable way, showcasing Wandoo’s human side.

- Encouraged user participation without immediate financial pressure, building trust and brand recognition.

- Created a positive emotional connection between the company and its customers, increasing long-term retention.

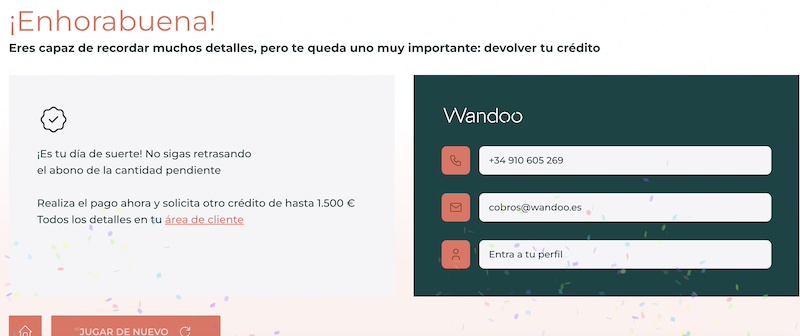

3. Win-or-Lose Mechanics with Real Rewards

To further drive engagement, we introduced win-or-lose mechanics within the games, where players could:

- Earn discounts, fee waivers, or better loan terms by winning certain challenges.

- Experience game-based risk and reward, creating a psychological incentive to return and play again.

- See a direct correlation between positive financial behavior and tangible benefits, reinforcing good repayment habits.

By integrating gamification into the collections and customer activation processes, Wandoo Finance boosted engagement, improved repayment rates, and strengthened customer relationships – all while maintaining a fun and user-friendly experience.

The games were designed to be flexible and customizable, allowing Wandoo Finance to:

- Tailor game mechanics, themes, and messaging to different customer segments.

- Continuously introduce new gamification elements to keep engagement high.

- Easily expand the system by adding new games and incentives in the future.

This modular approach ensured that Wandoo Finance could adapt and evolve its gamification strategy over time, keeping debt collection and customer engagement dynamic and effective.

Results and Impact

The gamification-driven approach to debt collection and customer engagement delivered measurable improvements for Wandoo Finance, transforming how customers interacted with repayment reminders and the brand itself.

1. Increased Repayment Rates & Faster Collections

- The introduction of interactive game-based reminders led to a notable increase in on-time repayments compared to traditional debt collection methods.

- Customers engaged more willingly with repayment reminders, reducing the need for aggressive follow-ups and lowering delinquency rates.

2. Higher Customer Engagement & Positive Brand Perception

- Customers responded positively to the playful, non-intrusive approach, with higher click-through rates on game-based reminders than standard emails or SMS messages.

- Gamification improved brand sentiment, positioning Wandoo Finance as an innovative and customer-friendly lender.

3. Boosted Retention & Repeat Borrowing

- Customers who engaged with the games were more likely to return for future loans, recognizing Wandoo Finance as a borrower-centric platform.

- The reward system encouraged loyalty, reinforcing responsible repayment behavior through tangible benefits like discounts and perks.

4. Scalable & Customizable for Future Growth

- The modular game system allowed Wandoo Finance to continuously refine and expand its gamification strategy, adding new mechanics and incentives over time.

- The approach proved adaptable to different market conditions, ensuring long-term effectiveness in debt collection and customer engagement.

By turning debt collection into an interactive experience, Wandoo Finance and z3x redefined customer engagement in financial services, demonstrating that gamification can drive both business performance and customer satisfaction.

Conclusion

The collaboration between Wandoo Finance and z3x proved that gamification can revolutionize debt collection and customer engagement in the financial sector. By integrating interactive, reward-driven mechanics into the repayment process, Wandoo Finance successfully boosted repayment rates, strengthened customer relationships, and enhanced brand perception – all while making the experience more engaging for users.

This case study highlights that financial services don’t have to rely solely on traditional, often punitive approaches to debt collection. Instead, by leveraging playful, psychology-driven incentives, companies can motivate customers in a positive way, leading to higher efficiency, reduced friction, and stronger customer loyalty.

Moreover, with a scalable and customizable gamification system, Wandoo Finance is well-positioned to continue innovating in the space, adapting to changing customer behaviors and market conditions.

At z3x, we specialize in helping businesses turn complex financial processes into seamless, engaging experiences—because when customers enjoy the journey, results naturally follow.

For financial institutions looking to enhance debt collection strategies and improve customer engagement, this case study demonstrates the power of gamification-driven solutions. Whether you aim to boost repayment rates, reduce operational inefficiencies, or create a more customer-friendly collections process, we bring the expertise and innovation to make it happen.

At z3x, we specialize in turning financial challenges into engaging, effective experiences. Let’s build the future of debt collection and customer engagement together.