How to Scale Your E-commerce Abroad: Key Challenges and Solutions

Author

Karol ZielinskiExpanding your e-commerce business to international markets is a significant milestone, but it comes with its share of challenges. On one hand, it opens up incredible opportunities – access to new customers, increased revenue, and greater brand recognition. On the other hand, it requires careful planning and technical adjustments to ensure success and avoid common pitfalls.

If you’re wondering what obstacles you might face and how to navigate them, you’re in the right place. Based on years of experience helping businesses scale internationally, we’ve identified three universal challenges you’ll likely encounter. In this article, we’ll break them down and show you how to address them effectively so that your expansion gets off to the right start.

Why Scaling an E-commerce Business Abroad is Challenging

Scaling an e-commerce business to international markets may sound straightforward at first, but the reality is often far more complex. It’s not just about translating your website or adding a new currency – it’s about adapting to the unique requirements of each market.

Every country comes with its own set of rules, from local regulations and tax policies to cultural differences and consumer preferences. Without proper preparation, these hurdles can quickly derail your expansion. Issues like poor user experience, compliance problems, or unanticipated costs can eat into your margins and customer satisfaction. That’s why expanding internationally requires a well-thought-out strategy, technical expertise, and a deep understanding of the target market.

Three Universal Challenges You’ll Face When Scaling Internationally

While every market has its own nuances, there are three challenges that virtually every e-commerce business will encounter when expanding internationally:

- Adapting Your Store to Local Realities

Scaling your store isn’t as simple as translating your website. Localization is a much deeper process. It involves adapting content to fit local cultural norms, preferences, and buying habits. It also requires addressing legal requirements like privacy policies, product labeling standards, and return policies. Without proper localization, you risk alienating potential customers or running afoul of local regulations. - Adjusting Payment Methods

Payment preferences vary significantly by market. The methods that work in your home country may not be relevant or trusted in your target market. This often means finding a new payment provider or integrating local payment methods. Beyond that, you’ll need to consider the operational challenges of new payment methods, such as higher chargeback rates, lower acceptance ratios, or delayed payouts. Preparing for these differences upfront can save you from major headaches later. - Managing Currency Risks

Accepting payments in a foreign currency introduces new complexities, especially if you plan to convert those funds into your local currency. Currency conversion can be handled by payment gateways, banks, or even manually – but it needs to be optimized to minimize losses. Many businesses overlook this step and end up losing money due to unfavorable exchange rates or hidden fees. Setting up an efficient currency management system early on can make a huge difference.

By addressing these three areas, you’ll be well on your way to overcoming the most common hurdles of scaling your e-commerce business abroad.

Adapting Your Store for a Foreign Market

Expanding your e-commerce store to a foreign market requires much more than simply translating your website. While language is a critical component, successful international expansion depends on localization, a comprehensive approach to adapting your store to the cultural, legal, and consumer expectations of your target audience. Localization ensures that your business not only communicates effectively but also resonates with customers on a personal level, fostering trust and confidence in your brand.

Cultural adaptation is one of the most overlooked aspects of localization. Different markets have unique preferences, customs, and buying behaviors that influence how customers interact with e-commerce stores. For example, color schemes, imagery, and even product descriptions that work well in one country might not have the same effect in another. In some cases, they could even deter potential customers. By understanding the cultural nuances of your target market, you can make design and messaging decisions that feel familiar and relevant, encouraging customers to engage with your store.

Another critical area is regulatory compliance. Every country has its own set of laws and regulations governing e-commerce operations, from privacy policies and data protection to product labeling and return policies. For instance, in some regions, consumers are entitled to extended return windows or specific guarantees that may not exist in your home country. Ensuring that your store adheres to these local regulations is not only a legal requirement but also a way to build credibility with customers who expect these standards to be met.

User experience adjustments are equally important. Payment options, delivery methods, and website functionality need to align with what customers in your target market are accustomed to. For example, while one market might prioritize mobile-friendly designs and quick checkout processes, another might value detailed product pages and robust customer support options. Adapting your store’s features to meet these expectations can significantly improve conversion rates and customer satisfaction.

Lastly, localization involves technical adjustments, such as implementing local currencies, integrating popular regional payment methods, and optimizing for search engines in the target market’s language. This might also include updating product catalogs to reflect locally relevant items, sizes, or variations. These details may seem small, but they play a crucial role in ensuring a seamless shopping experience that makes customers feel your store was designed with their needs in mind.

Properly adapting your store for a foreign market is not a one-time effort but an ongoing process of learning and refining. As you gain insights into your new audience and their preferences, you can continue to optimize your store to meet their expectations better. By investing in thorough localization, you set the foundation for long-term success in your international expansion.

Setting Up Payment Methods for a New Region

When expanding your e-commerce business to a new region, setting up the right payment methods is one of the most critical steps. Payment preferences vary widely between markets, and failing to adapt your payment systems to local norms can lead to cart abandonment and lost sales. The goal isn’t just to enable transactions; it’s to create a payment experience that feels natural and seamless for your customers in the target region.

Understanding local payment preferences is the first step. Every market has its own dominant payment methods, from credit and debit cards to digital wallets, buy-now-pay-later (BNPL) services, and even local payment solutions unique to that region. For example, while credit cards might be the most popular method in the United States, customers in countries like Germany may prefer bank transfers, and customers in the Netherlands often rely on iDEAL. Offering the right mix of payment methods ensures that customers can complete their purchases in the way they trust and prefer.

However, choosing a payment provider that supports these methods isn’t always straightforward. Some global providers offer a wide range of payment options, but they may handle certain methods through third-party integrations, which can lead to a disjointed user experience. For instance, your customer might be redirected to another platform to complete their payment, which increases friction and reduces trust. On the other hand, local providers might offer seamless integration for region-specific methods but lack global scalability. Balancing these trade-offs is essential when selecting a provider.

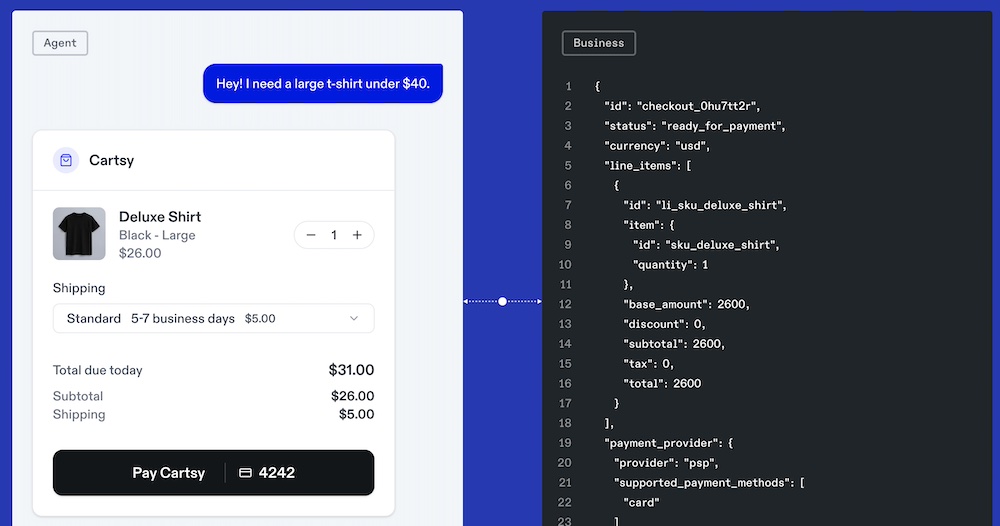

Integration challenges are another critical aspect to consider. Beyond just supporting the right payment methods, your payment provider must offer robust integration capabilities that align with your operational needs. This includes having APIs that support features like one-click payments, recurring billing, and multi-currency settlements. Unfortunately, many businesses discover too late that their provider’s integration capabilities fall short, leading to costly delays and workarounds. Testing and validating these integrations before launching in a new region can save significant time and resources.

Operational complexities also increase when you introduce new payment methods. Each payment option comes with its own set of challenges, such as handling higher chargeback rates, dealing with fraud risks, or navigating lower acceptance ratios for certain card networks. Additionally, payout timelines can vary significantly between providers and methods. While some providers settle funds within days, others might take weeks, impacting your cash flow. Being prepared for these operational differences ensures smoother financial management as you scale.

Finally, transparency and cost management are crucial. Payment providers often charge fees for transactions, currency conversion, and other services. While these fees are inevitable, understanding and comparing providers’ pricing structures can help you minimize costs. Remember that the lowest transaction fee doesn’t always equate to the best value if the provider lacks the flexibility, reliability, or customer support your business needs.

Setting up payment methods for a new region is about more than just functionality; it’s about creating a payment experience that aligns with the expectations of your customers and the operational realities of your business. By prioritizing local preferences, robust integrations, and cost-effective solutions, you can ensure that your payment system becomes a driver of success rather than a source of frustration in your international expansion.

Managing Foreign Currency

Accepting foreign currencies may seem straightforward at first glance, but it comes with layers of complexity that can catch even seasoned business owners off guard. Once you enter a new market, you must handle both transaction currency and settlement currency effectively. Transaction currency refers to the currency your customer uses to pay, ensuring a seamless experience – if your store shows €10, that’s exactly what your customer expects to see on their statement. Settlement currency, however, is the currency in which your payment provider deposits funds into your account. If these two don’t align, challenges can arise quickly.

One common issue is currency conversion mishandling. Many payment providers automatically convert transaction currencies into their preferred settlement currency, often without giving you control over the rates or timing. This can result in unfavorable exchange rates and hidden fees that chip away at your profits. For example, if your provider converts all euro transactions into US dollars and your bank later converts them into your local currency, you could end up paying double conversion fees. These unnecessary costs add up, particularly as your sales volumes increase.

To avoid these pitfalls, it’s crucial to choose a payment provider that offers flexibility in how you handle currencies. Ideally, you want the ability to settle funds in the same currency your customers use, or, if conversion is necessary, to have control over when and how it happens. In some cases, businesses opt for specialized foreign exchange solutions or multi-currency accounts to manage their funds more effectively. This allows them to take advantage of competitive rates and avoid relying solely on their payment provider’s built-in conversion tools.

Proper currency management isn’t just about minimizing losses – it can also become a strategic advantage. By optimizing your currency handling processes, you can reduce operational costs and improve your margins. For businesses dealing with significant transaction volumes across multiple markets, a well-thought-out currency strategy can even create opportunities to gain additional revenue. Addressing these challenges proactively ensures that currency risks don’t erode the benefits of scaling your e-commerce internationally.

Choosing the Right Payment Provider

Selecting the right payment provider is one of the most critical decisions you’ll make when scaling your e-commerce business internationally. It’s not just about finding a provider that can handle payments in your target market; it’s about finding one that aligns with your specific business needs, customer expectations, and long-term goals. The wrong choice can lead to integration headaches, higher costs, and a poor user experience, all of which can hurt your conversion rates and brand reputation.

The first factor to consider is payment method coverage. Each market has its preferred ways to pay – credit cards might dominate in one country, while digital wallets or bank transfers are more popular elsewhere. It’s crucial to ensure that your payment provider supports the methods your target customers use most frequently. However, don’t stop at just confirming support. Ask whether the provider handles these methods natively or relies on external integrations. For example, some providers might technically support local payment options but require your customers to leave your website to complete the transaction, which can harm the user experience.

The second key consideration is currency handling. As discussed earlier, transaction currency and settlement currency can significantly impact your bottom line. Some providers allow you to settle in the same currency as your transactions, while others convert it automatically, often at less favorable rates. Ensure your provider offers flexibility in currency management and aligns with your strategy for minimizing conversion costs. It’s also worth asking whether the provider can handle multi-currency settlements, especially if you plan to expand to multiple markets.

Another often-overlooked factor is integration capabilities. It’s not enough for a payment provider to support the features you need; they must also offer the technical infrastructure to make those features work seamlessly with your platform. For instance, if you plan to implement one-click payments, subscription billing, or advanced fraud prevention, ensure that the provider’s API can handle these requirements. Poor integration can lead to functionality gaps that frustrate your customers and undermine the efficiency of your operations.

Lastly, while cost is always a consideration, it shouldn’t be your primary focus when starting out. Competitive rates are important, but they should come after ensuring the provider meets your technical, operational, and user experience needs. Remember, a slightly higher transaction fee might be worth it if the provider offers better service, reliability, and support. By prioritizing the right factors, you can avoid common pitfalls and set up a payment system that scales smoothly with your business.

Real-Life Lessons from Poor Integrations

When it comes to payment provider integrations, even small oversights can lead to major issues. Poorly planned or executed integrations don’t just frustrate your customers – they can also cost your business money, time, and credibility. From mismatched currencies to missing essential features, these mistakes are more common than you might think. Learning from real-world examples can help you avoid these pitfalls and ensure your payment processes are as smooth as possible.

One common issue arises from currency mismanagement during integration. For example, we worked with a client who scaled their e-commerce store to Norway and began accepting payments in NOK. However, their payment provider automatically converted all NOK transactions into the EUR before depositing the funds. This client didn’t have a EUR account because they were located in a non-EUR country. This double currency conversion – first by the provider and then by the client’s bank – led to significant losses on exchange rates. Worse, the client hadn’t even realized this was happening for months. Once we identified the issue, switching to a provider that allowed NOK settlements immediately improved their margins and reduced unnecessary costs.

Another frequent problem is poor API functionality. We’ve seen businesses sign contracts with providers, expecting a seamless setup, only to discover that critical features were missing or difficult to implement. For instance, one client wanted to enable one-click payments and recurring billing for subscriptions. After first integration, they realized the provider’s API didn’t fully support these features. This not only delayed their launch but also required additional workarounds, increasing costs and wasting time. These situations highlight the importance of thoroughly vetting a provider’s technical capabilities before signing on.

A particularly damaging scenario involves compromising user experience due to incomplete integrations. One client found that their payment provider required redirecting customers to a third-party platform for local payment methods. While the provider technically supported the payment methods, the experience was far from seamless. Redirecting customers disrupted the checkout flow, leading to increased cart abandonment rates. Switching to a provider that could handle these payments natively solved the problem and significantly improved their conversion rates.

Finally, we’ve seen businesses prioritize low transaction fees over functionality, only to regret it later. One client chose a provider with the cheapest rates but didn’t account for their limited fraud prevention tools. This decision led to an increase in chargebacks and losses due to fraud, ultimately negating any savings on fees. The lesson here? The cheapest option is rarely the best when scaling internationally. Focusing on reliability, flexibility, and user experience pays off in the long run.

These real-life examples underscore the importance of careful planning and thorough research when choosing and integrating a payment provider. A well-executed integration isn’t just about getting the basics right – it’s about creating a system that supports your business goals, reduces friction for your customers, and sets you up for long-term success.

Focus on the Big Three First

When scaling your e-commerce business to international markets, it’s tempting to tackle every challenge at once. However, experience shows that focusing on three key areas – store localization, payment setup, and currency management – delivers the most significant results early on. These foundational elements address the most common pain points businesses face when expanding abroad and set the stage for a smoother scaling process.

Localization is the cornerstone of any successful international expansion. It’s not just about translating your website; it’s about adapting your store to meet the cultural, regulatory, and consumer expectations of your target market. A localized store feels familiar and trustworthy to customers, which can make all the difference in building their confidence to shop with you. Neglecting this step can result in low conversions and missed opportunities.

Payment setup is another critical area that requires your attention from the start. Every market has its own payment preferences, and failing to offer the right options can drive customers away. Ensuring your payment provider supports popular methods, integrates seamlessly with your store, and handles local currencies efficiently is vital. Skipping this step often results in poor user experiences, increased cart abandonment, and operational headaches down the line.

Currency management may seem like a small detail, but it can have a significant impact on your bottom line. Accepting payments in foreign currencies introduces risks and opportunities—how you manage conversion rates, settlement currencies, and related fees can either save you money or create unnecessary losses. Setting up a clear strategy for handling foreign currencies early on ensures you maximize your revenue potential while minimizing avoidable costs.

By addressing these three areas first, you can eliminate many of the common hurdles associated with international scaling. It’s not about perfecting everything from day one but about building a strong foundation that allows your business to grow confidently in new markets. Once these elements are in place, you’ll be better equipped to tackle additional challenges and opportunities as they arise.

Ready to scale your e-commerce to new markets? Let’s simplify the complexities together and set up solutions that truly work for your business.

Contact us today and start building your global success!