What is a chargeback and how does it work?

Author

Karol ZielinskiChargeback is a consumer/payer protection mechanism used in card payments that allows a customer to recover money from a card transaction if they believe the payment was incorrect, unauthorized, or if the goods/services were not delivered as agreed. The chargeback process is initiated by the customer's bank, not the merchant - and that is exactly what makes it different from a traditional refund.

Chargeback - in more detail

In practice, a chargeback is a procedure in which the card-issuing bank can reverse funds from the merchant's account and return them to the customer. It is a form of protection against fraud, system errors, or unfair merchant practices.

Although the mechanism was created mainly with consumers in mind, in practice it also affects merchants. Every chargeback is a potential loss of money, reputation, and time for the store. And if the chargeback is upheld - we are not only talking about returning the transaction amount, but also additional costs associated with processing the chargeback.

How chargeback works - step by step

The chargeback process can be described in a few simple stages:

- The customer files a dispute with their bank, claiming for example that they did not make the transaction, that the goods were not delivered, or that the product did not match the description.

- The issuing bank - the one that issued the customer's card - reviews the claim and refunds the customer (depending on the bank, this may differ - sometimes funds are returned immediately, sometimes only after the full chargeback process is completed).

- The chargeback information is passed through the card network (Visa, Mastercard, etc.) to the acquirer handling the merchant, and then to the store.

- The store may accept the claim or present evidence that the transaction was valid (e.g., delivery confirmation, email approval, system logs).

- The card issuer makes a decision - if the customer is found to be right, the funds remain returned to them, and the merchant loses the money and often pays an additional fee.

- After the decision, there is an option to appeal, and the case moves to the "higher instance", meaning the card scheme, which may uphold the issuer's decision or overturn it. This decision is final. For the merchant, this usually means additional fees.

Most common reasons for chargebacks

Although the reasons may vary, most chargebacks fall into a few main categories:

- Unauthorized transaction - the customer claims they did not make the purchase (e.g., stolen card data).

- Product or service not delivered.

- Product significantly differs from the description (e.g., defective, non-original, incomplete).

- Technical error - e.g., duplicate transaction.

- The customer did not recognize the payment on their statement and reported it by mistake.

How long does the chargeback process take?

Typically, the customer has from one to several - or even a dozen or more - months (depending on the card network, the type of transaction, and what the payment was for) to file a chargeback. The entire process can take from several weeks to several months - depending on the complexity of the case, the amount of evidence, and the response time of both sides.

How can a merchant protect themselves from chargebacks?

The best defense is prevention. Chargebacks often result not from fraud but from communication errors, unclear product descriptions, or lack of response to customer issues.

- Ensure product and service descriptions are clear, and the return policy is visible and easy to understand.

- Send order confirmations and invoices via email.

- Monitor and respond to complaints quickly - a customer who receives support is less likely to file a chargeback.

- Store proof of order fulfillment (delivery confirmation, customer signature, system logs).

- Use payment gateways and anti-fraud systems that automatically detect suspicious transactions.

Fees and consequences for the merchant

Each chargeback means not only losing the transaction amount but also an additional fee charged by the payment provider (usually €10–25). A high number of chargebacks can also affect the shop's reputation - operators and banks may classify it as "high-risk", increase fees, terminate the contract, or even place the merchant on a blacklist.

Chargeback vs refund - what's the difference?

This is a very common question.

A refund is a standard return - initiated by the merchant, usually after an agreement with the customer.

A chargeback, on the other hand, is a transaction reversal enforced by the bank (at the customer's request) - without the merchant's consent.

In short, most often: refund = voluntary return, chargeback = forced return.

How to reduce the risk of chargebacks?

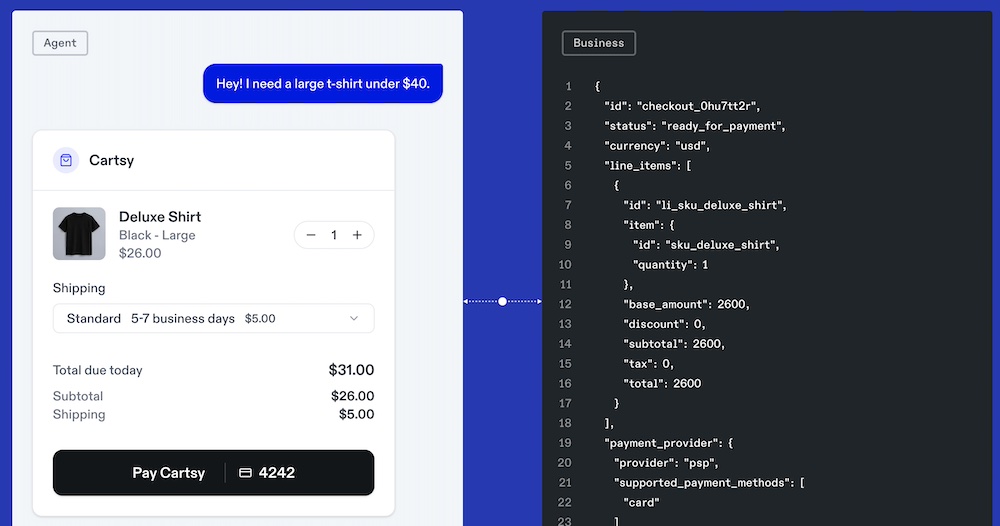

- Use 3D Secure systems.

- Ensure your business name is easily recognizable on bank statements.

- Respond quickly to customer inquiries and avoid unclear communication.

- Use anti-fraud and scoring tools in payment gateways or your own solutions.

- Clarify terms and policies, offer easy returns and refunds.

- Regularly analyze the causes of chargebacks - many can be eliminated with small improvements to the purchase process.

FAQ: most frequently asked questions about chargebacks

1. Is the customer always right in a chargeback?

Not always. The merchant has the right to provide evidence that the transaction was valid. If the evidence is convincing (e.g., delivery confirmation, customer signature, IP logs), the issuer or card network may reject the customer’s claim.

2. How long does it take for the customer to get their money back?

It depends on the bank. Increasingly, issuers return funds within a few days, but final confirmation occurs only after the entire process ends. In some cases, the bank waits until the end of the process before refunding the customer.

3. Can a merchant avoid chargeback fees?

Usually not. Most payment processors or acquirers charge a fee regardless of the outcome. When a case goes to the second stage of review, additional fees often apply. High chargeback ratios may also lead to penalties.

4. Do chargebacks apply only to card payments?

Yes - the chargeback mechanism is part of the Visa, Mastercard, American Express, etc. systems. Bank transfers or BLIK follow different dispute procedures.

5. Can I appeal a chargeback decision?

Yes, but due to additional fees it should be considered only when you have strong evidence. If the card network sides with the merchant, the funds may be returned.

6. Do chargebacks affect a store's reputation?

Yes. A high chargeback rate may place your shop on a risk list maintained by the payment processor, acquirer, or even card schemes, making negotiations with payment operators more difficult.

7. Can chargebacks be prevented completely?

No. Every online store will face them sooner or later. But you can significantly reduce their frequency by using good practices, transparent communication, and solid customer support processes.

8. What if I don't know how to handle chargebacks in my SaaS or e-commerce business?

You contact people who specialize in this and ask for help. Z3x provides such services, including payment gateway integrations and fintech consulting.