What is a Payment Gateway? A Complete Guide for Online Business

Author

Karol ZielinskiA payment gateway is a service and technology that enables secure acceptance of electronic payments in an online store or application. It acts as an intermediary between the buyer, the store, and the financial institution - it encrypts card or other payment method data, sends it to the bank or payment processor, and returns the information whether the transaction was approved. Without a payment gateway, an online store cannot securely accept payments from customers.

More specifically – what is a payment gateway?

Before we dive into the details – imagine you run an online store, the customer clicks “Buy”, enters their card details and... what happens next? Between the moment of clicking and the moment the money lands in your account, a series of systems and processes come into play to “pass through” the payment. One of the key elements of this process is a payment gateway – that “virtual terminal” responsible for securely transmitting payment data, authorizing the payment, and connecting the customer, the store, and the bank.

In practice: a payment gateway is both a technology and a service that enables your store to accept online payments (or also in a physical store) in a secure, fast, and professional way.

How does a payment gateway work?

Step by step:

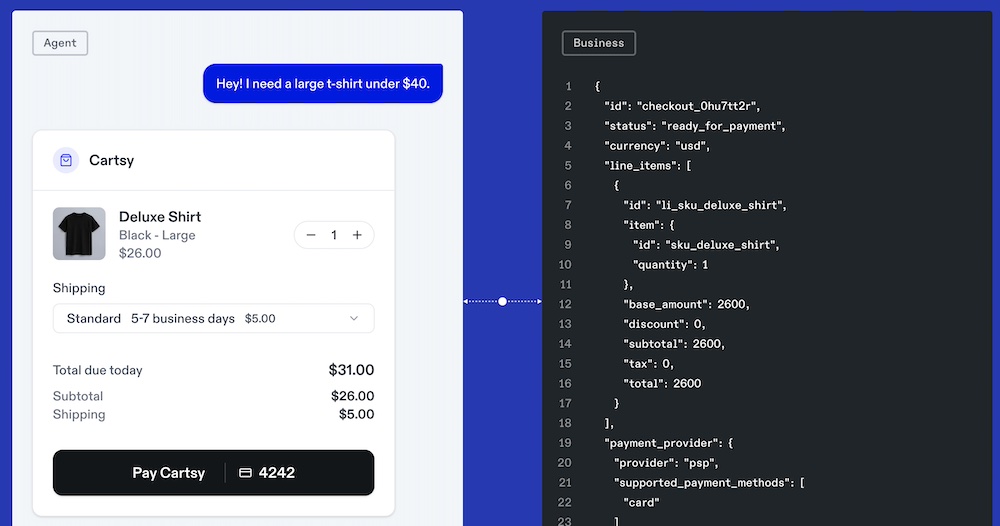

- The customer selects a product, clicks “Pay”, and enters their payment details (card, digital wallet, another method).

- The payment gateway captures and encrypts the data, then sends it to the payment processor, card issuer bank, or possibly other intermediaries.

- The bank checks: whether the card works, whether there are sufficient funds, and whether there is any suspicion of fraud. It sends a decision: approve or decline.

- The gateway receives the decision and forwards it back to the store and the customer — “payment accepted” or “declined”.

- In the background, settlement occurs. The customer has been charged, and the funds should reach the store’s account (or the intermediary’s account).

What tasks does a payment gateway perform?

There are many tasks involved. However, the most important ones are:

- secure capturing and encryption of payment data

- sending data to the appropriate payment institutions

- communicating the decision (approved/declined)

- supporting various payment methods, currencies, and sometimes countries

Why is a payment gateway crucial for your online business?

Simply put: without it, your store cannot professionally accept cards, digital wallets, or local payment methods like BLIK, and the customer may give up because the payment flow seems risky or unclear.

Additionally, with a good payment gateway you reduce the number of abandoned carts - the customer sees a secure payment window and trusts the process. It also enables you to scale: international sales, multiple currencies, fast settlement.

And finally: risk. A payment gateway minimizes risk - good gateways have anti-fraud tools and comply with industry security standards (e.g., PCI DSS).

What to consider when choosing a payment gateway

To start, we recommend paying attention to:

- Which payment methods does it support (Visa/Mastercard cards, wallets, local bank transfers, installments, BNPL, alternative payment methods)?

- Does it work in the countries where you sell? Does it support currencies and languages? What are the transaction + monthly fees?

- What does the technical integration look like - is there a plugin for your e-commerce platform, or does it require custom development?

- What security standards does it support - encryption, compliance with industry norms and certifications?

- Is the customer experience smooth after integration (fast checkout, no unnecessary steps)? The easier the payment, the better the conversion.

- Does the gateway have good support and reputation? If something goes wrong (refunds, chargebacks, errors), you want a partner - not a problem.

FAQ: frequently asked questions about payment gateways

1. Which payment gateways do you recommend?

Every gateway is different and has its own pros and cons. Before choosing one, it’s worth comparing several options and selecting the solution that best fits your business needs. Among the widely recommended ones, you can consider Stripe and Adyen for global markets, and PayU, TrustPay, and Autopay, if you primarily target domestic markets.

2. Can I run an online store without a payment gateway?

If you want to accept online payments - no. A payment gateway is essential for securely processing card payments, BLIK, wallets, etc. Without it, the only option left would be a traditional bank transfer.

3. Does a payment gateway store customers’ card data?

Each gateway works differently. Some store card data, others do not. Some use tokenization, others may not. The key point: when integrated with a gateway, card data does not pass through the store itself - and that is what ensures security.

4. Which payment methods can I connect through a gateway?

It depends on the provider and the region it supports. Usually: debit and credit cards. Additionally, if the gateway focuses on a specific local market, it may also offer methods like BLIK, Apple Pay, Google Pay, fast bank transfers, digital wallets, BNPL, installments, etc.

5. How much does a payment gateway cost?

The most common model includes:

- a transaction fee (e.g. 1–3%),

- sometimes a small fixed or monthly fee.

Details depend on the operator, sales volume, and country of operation.

6. Does the choice of gateway affect conversion?

Yes. If the payment is slow, requires too many steps, or redirects to unknown pages, some customers simply give up. A good gateway = fewer abandoned carts = more sales.

7. What is the difference between redirected payments and on-site payments?

Redirect - the customer is taken to the payment provider’s site (secure, but more risk of abandonment).

On-site payment - the entire payment process happens within the store’s domain (better control over UX, but requires more responsibility and integration).

8. Can I easily switch to another gateway?

Usually yes - especially if you use popular platforms like Shopify, WooCommerce, or PrestaShop. But always test thoroughly before migrating, since this is a critical part of the store.

9. Is one gateway enough?

For a start - yes. But larger stores often use payment routing and so-called payment orchestration - multiple gateways with smart distribution of transactions to minimize declines and costs. That’s a topic for a separate article.

10. What if I don’t know which gateway to choose or how to integrate it with my store?

You reach out to people who know how to do it and ask for help. Z3x provides such services, including payment gateway integrations, payment orchestration implementations, and assistance in selecting the right payment gateway.