Why Fintech Companies Need Marketing?

Author

Karol ZielinskiNowadays, fintech companies are at the forefront of transforming how individuals and businesses manage their finances. From mobile banking and peer-to-peer lending to blockchain and robo-advisors, fintech innovations are revolutionizing the financial services industry. However, the success of these solutions hinges not just on technological prowess but also on effective marketing strategies. Here’s why fintech companies need marketing.

1. Building Brand Awareness

The fintech sector is crowded with startups and established players, each screaming for attention. Effective marketing is mandatory for fintech companies to differentiate themselves from competitors and build brand awareness. A well-crafted marketing campaign can highlight the unique value propositions of a fintech solution, making it stand out in a sea of similar offerings. This visibility is essential for attracting investors, partners, and, most importantly, customers.

The strategy of targeting the tech-savvy millennial is no longer sufficient in the B2C fintech world. If you really want to make finance accessible and democratise it, then you need to target the average layperson, and that requires effective marketing.

https://swissfinte.ch/seven-reasons-fintech-companies-need-marketing/

2. Educating the Market

Fintech innovations often involve complex technologies and new business models that the general public may not fully understand. Marketing plays an important role in educating potential customers about these new technologies. Through content marketing, webinars, explainer videos, and social media engagement, fintech companies can demystify their products and services, explaining how they work and the benefits they offer. This educational aspect is crucial for building trust and encouraging adoption.

3. Establishing Trust and Credibility

Trust is paramount in the financial sector. Customers need to feel confident that their money and personal information are secure. Effective marketing can help fintech companies build this trust by showcasing their commitment to security, compliance with regulations, and partnerships with established financial institutions. Testimonials, case studies, and transparent communication about security measures and data protection practices can enhance a company’s credibility.

4. Driving Customer Acquisition and Retention

Marketing is essential for acquiring new customers and retaining existing ones. Through targeted advertising, search engine optimization (SEO), and social media marketing, fintech companies can reach potential customers who are actively seeking financial solutions.

Additionally, personalized email marketing and loyalty programs can help maintain engagement with existing customers, encouraging them to stay with the company and use more of its services.

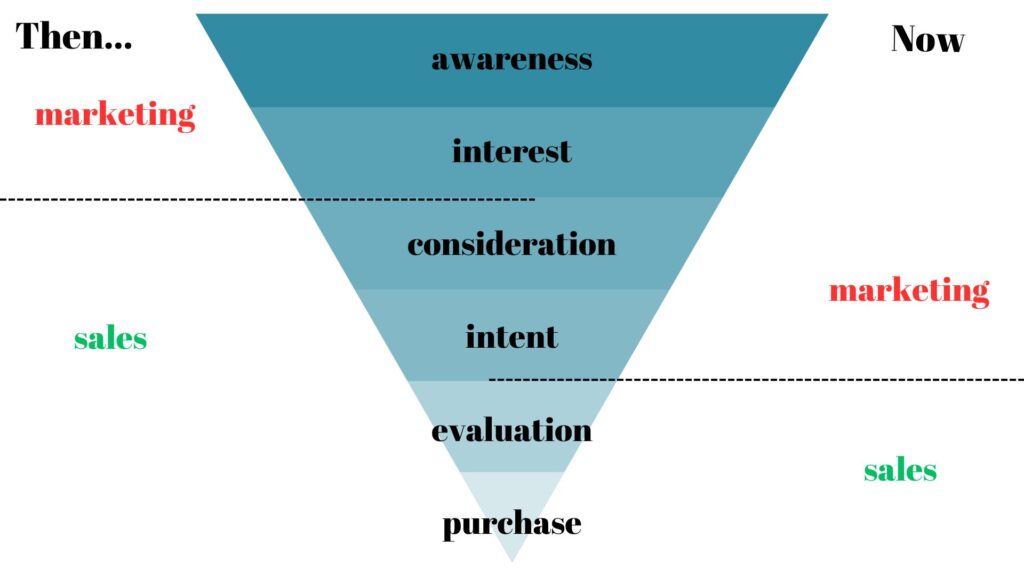

5. Marketing is taking up a larger part of the sales funnel

Before the internet, shopping options were limited. People usually chose what was most convenient or relied on recommendations from friends.

Now, with tools like Google, we can thoroughly research our purchases. We read comparison articles, check reviews, and participate in forums. We prefer to find answers to our questions online and make decisions independently before reaching out.

Sales remain important, but marketing increasingly dominates the process. Selling becomes much easier when potential buyers have already researched and selected you as their provider or product.

Nowadays, where customers value the ability to research independently, marketing is crucial for all companies, not just those in fintech. Marketing provides essential information, addresses common questions, and educates potential customers, helping them make informed decisions.

For fintech companies, effective marketing is key to staying current with modern customer acquisition practices.

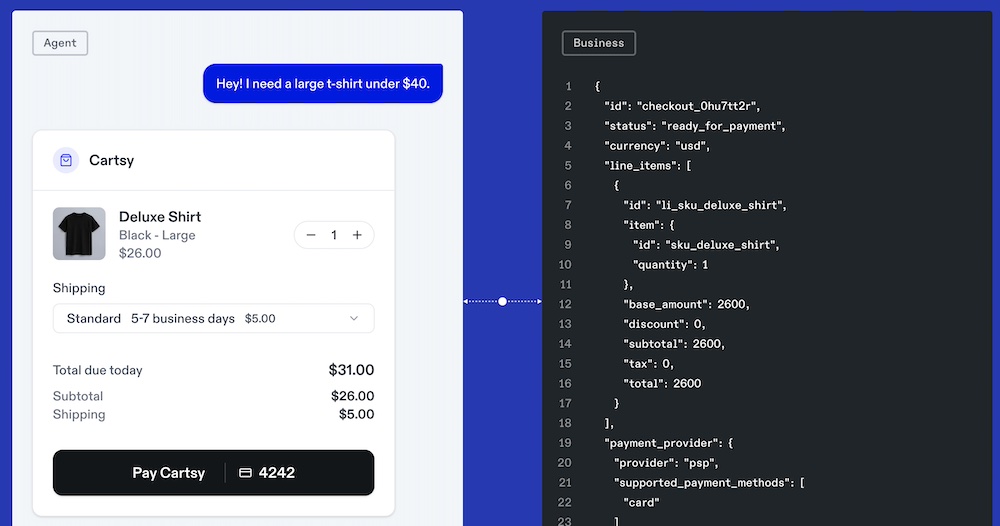

6. Leveraging Data for Personalized Marketing

Fintech companies have access to extensive data on their customers’ financial behaviors and preferences. This data is invaluable for creating highly personalized marketing campaigns. By analyzing user data, fintech companies can segment their audience and deliver targeted messages that resonate with specific customer groups.

Personalized marketing not only enhances customer experience but also improves conversion rates and fosters customer loyalty. This creates a positive cycle: the more targeted and customer-centric your marketing, the more effectively you reach the right audience.

Having marketers who deeply understand your customers is crucial for driving company growth.

7. Adapting to Market Trends

The fintech industry is characterized by rapid changes and evolving market trends. Marketing enables fintech companies to stay agile and responsive to these changes.

By monitoring market trends and customer feedback, companies can adjust their marketing strategies and product offerings to meet emerging needs. This adaptability is crucial for maintaining a competitive edge in a dynamic industry.

Why Fintech Companies Need Marketing?

Marketing is not just a secondary function for fintech companies; it is a critical component of their success. From building brand awareness and educating the market to establishing trust and driving customer acquisition, effective marketing strategies are essential for navigating the complexities of the fintech landscape.

As the industry continues to evolve, fintech companies that prioritize marketing will be better positioned to innovate, grow, and succeed. If you need any help with your tech marketing, contact us.

Btw. Interested in good marketing cases? Take a look at these: